What Does Flood Insurance Cover?

Flood insurance is designed to protect you in case your home or business in flooded. This type of flood insurance covers the same perils as homeowner’s insurance, but also protects you in case of flooding. A typical flood policy will reimburse you for the cost of repairing or replacing your home after a flood, the cost of personal items destroyed, and the cost of moving your family to temporary shelter if your home is destroyed.

The bottom line is that if floodwater causes damage to your property, flood insurance can cover that damage. In fact, you be required to have flood insurance if you live in a flood hazard area, as determined by the Federal Emergency Management Agency (FEMA).

What Doesn’t Flood Insurance Cover?

Typically, flood insurance does not insure against other causes of damage such as fire, earthquakes, hurricanes and hail. To determine whether or not you need flood coverage, and how much, our team is standing by to offer you a free consultation and answer your questions. Contact us today!

Other Policies

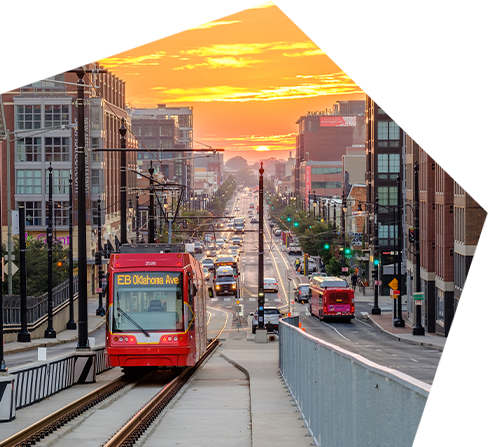

4115 Annandale Rd Ste. 300 Annandale, VA 22003

50 South Pickett St. #20 Alexandria, VA 22304