What Kinds of Business Insurance are Available?

Every business type, no matter how small or large, should have some basic types of insurance in place. These include liability insurance for any injuries that occur while on the property, worker’s compensation to cover employee accidents, and property insurance to cover damage done to the premises during a fire or other disaster.

Smaller businesses may be able to get by with less coverage. For example, a small shop might only need to purchase property insurance for the building and not worry so much about commercial vehicle insurance or umbrella liability, while a larger business may require extra precautions, such as commercial auto coverage or umbrella policies to protect against litigation.

Which Kind of Business Insurance Do I Need?

Determining which options are best suited to your needs and the needs of your business can be a complex process and is best performed with an agent you trust. Our team has assisted a wide variety of businesses in our area, and we would be happy to offer you a free consultation on how to fully protect your enterprise. Contact us now and let’s get started.

Other Policies

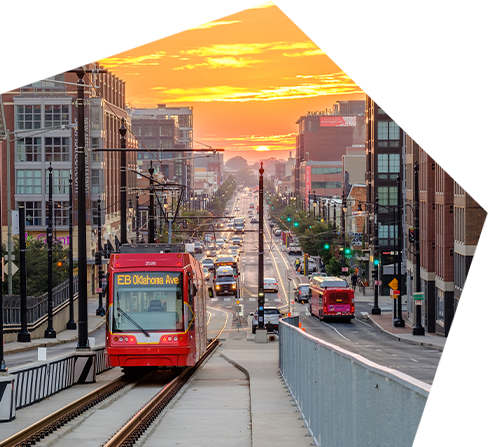

4115 Annandale Rd Ste. 300 Annandale, VA 22003

50 South Pickett St. #20 Alexandria, VA 22304